Pros and Cons of Leasing vs. Buying A Car

Deciding whether to get a new vehicle or not is one of the most important decisions a family can make. Next to buying a home, purchasing a vehicle is the largest financial investment a family will make. So many of you might be wondering which is better: Leasing vs. Buying A Car.

Choosing the make and model of your dream vehicle is the easy part, the harder part is being able to afford it. Some will save up for years to buy the car upfront; others will take out an auto loan. However, if you don’t want to deal with that stress, a viable option is to lease. Although not appropriate for everyone, a lease can be a great option for some.

Leasing A Car

In order to understand the comparison of Leasing vs. Buying A Car, driver must know the differences between these two. Here are the pros and cons for leasing a vehicle instead of buying one:

Pros of Leasing

Firstly, drivers can save more cash in their pockets since monthly payments tend to be significantly lower than auto loan payments. Secondly,you can live out your dream and drive a new car every two or three years. Thirdly, you are completely covered by the warranty. Last but not least, you can upgrade your car without the hassle of trading or selling your car.

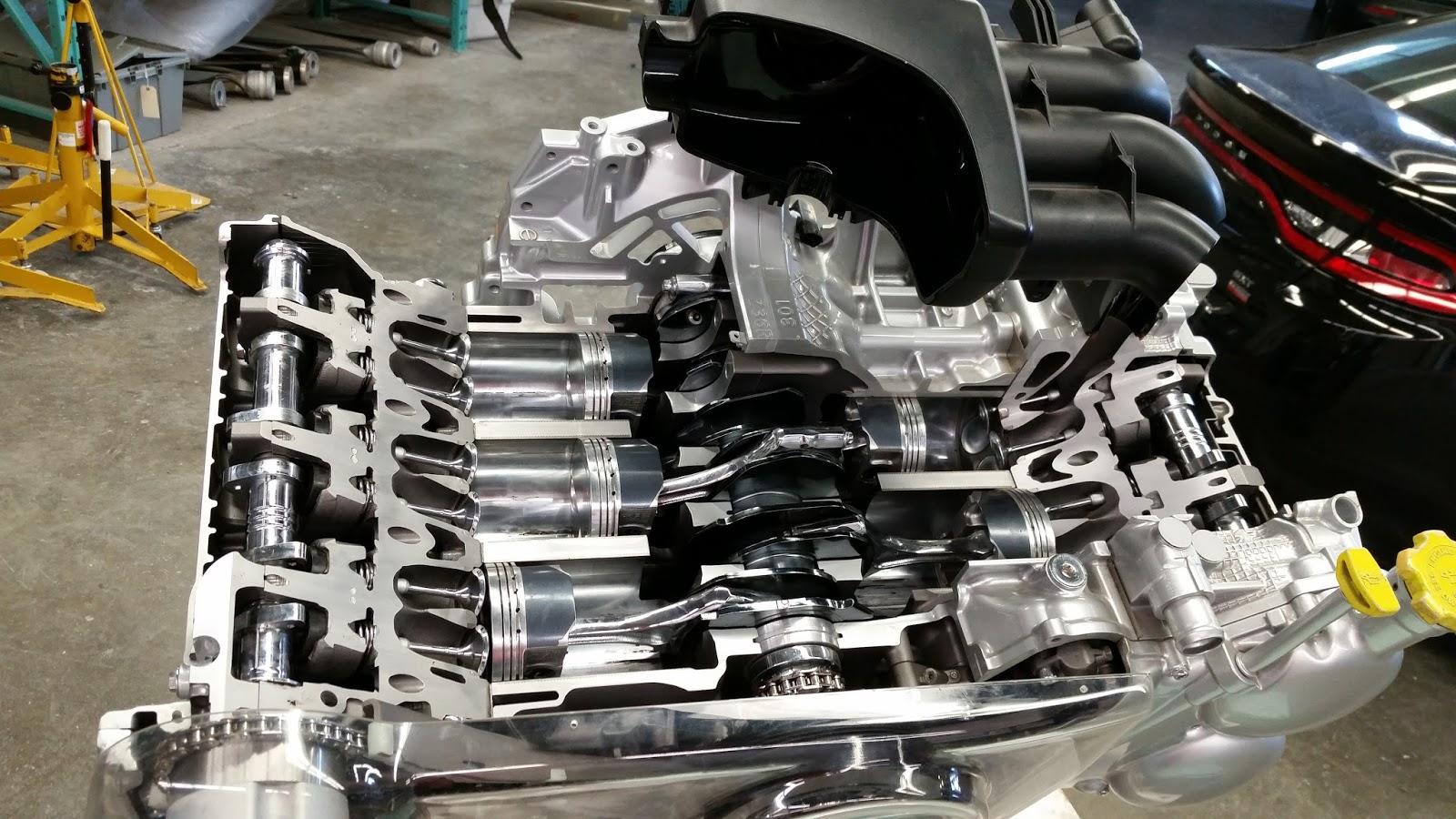

Leasing a vehicle typically costs up to 60% less per month than purchasing a vehicle with an auto loan. Not only will you be driving the same car for a fraction of the cost, you will also never have to worry about dealing with any major mechanical issues. You can rest assured that if anything happens to your car, you will be completely covered by its warranty.

Cons of Leasing

In order to lease a vehicle and keep up with the payments, it’s important that you have a stable and predictable income and lifestyle. Financial problems or unforeseeable events such as a major medical expense or losing your job can cause major issues with your lease contract. It’s important to remember that there are many terms you must meet. If you are unable to meet them, you will face fines. Things like having the financial capacity to keep up with regular maintenance and a routine that won’t surpass the allotted mileage is very important. For this reason it’s vital that you understand the fine print in your contract. Getting rid of your lease is not as easy as selling your car. So there are the cons of leasing car in Leasing vs. Buying A Car:

Firstly, you need a source of income that is both stable and predictable. Secondly, drivers also will be paying a premium for lease benefits. Thirdly, the vehicle must be consistently and properly maintained. Fourthly, your mileage is also limited. And lastly, under many circumstances you are required to purchase gap insurance.

Buying A Vehicle

Beside from normal car industry knowledge, we also suggest the knowledge of buying a vehicle. In the comparison of Leasing vs. Buying A Car, car owners should understand the pros and cons of purchasing one.

Pros of Buying

Obviously, you own your car, you have unlimited mileage and that is your freedom. Second of that, you can make any modifications to your vehicle and there is no one to stop you, you are the owners after all. You can upgrade your vehicle, even from cheap used car to maximize trade-in or resale value. Last but not least, you can keep driving your vehicle for years and spread the cost. There will be no charges to end a lease.

Not fearing the additional fees for driving too much or for modifications is a great freedom. Owning your car means no one can tell you what your car needs to look like or how far you can drive it. You have the power to do whatever you want with it. If you are completely committed to keeping your vehicle for the long haul and you have adequate car insurance, then you will most likely not lose out financially.

Cons of Buying

It is unfair in the Leasing vs. Buying A Car competition if there are no cons for buying a vehicle:

Firstly, payments are higher than a lease. There will be some cars that you really like, yet the costs are enormous.

Secondly, the post-warranty repair costs.

Last but not least, you are responsible for trading or selling your vehicle if you want a new one.

SEE MORE:

- All Drivers Need To Know About All Wheel And 4 Wheel Drive

- World Fastest 10 Cars All Car Owners Dream About

Other Consideration For Leasing vs. Buying A Car

It’s important to remember that leased vehicles need to be insured. If you buy your vehicle, you can simply purchase the minimum liability coverage required by your state. However, leased vehicles have more restrictions and will often restrict minimum liability coverage policies, which makes Leasing vs. Buying A Car is the challenge choice for all drivers.

Insurance policies for leased vehicles tend to be more boutique and therefore more expensive. It doesn’t matter if you decide to buy or lease a vehicle, it’s crucial that you meet with a reputable insurance provider to find the best possible coverage for you.

In the end, it all comes down to how long you want to be driving the vehicle. In the short term, leasing a vehicle is much cheaper. However, in the long term, buying a vehicle is typically the cheaper option. The initial costs of buying a vehicle are much higher, but the cons of buying a vehicle in the long term are minimal. It’s important to compare the pros and the cons of each option and then decide what is appropriate for you and your family.