Pros And Cons Of Title Loans: Is It The Right Option For You?

You may have seen advertisements for car title loans and wondered if they are a wise choice when you need cash quickly. The quick answer is yes if you know how to do it right.

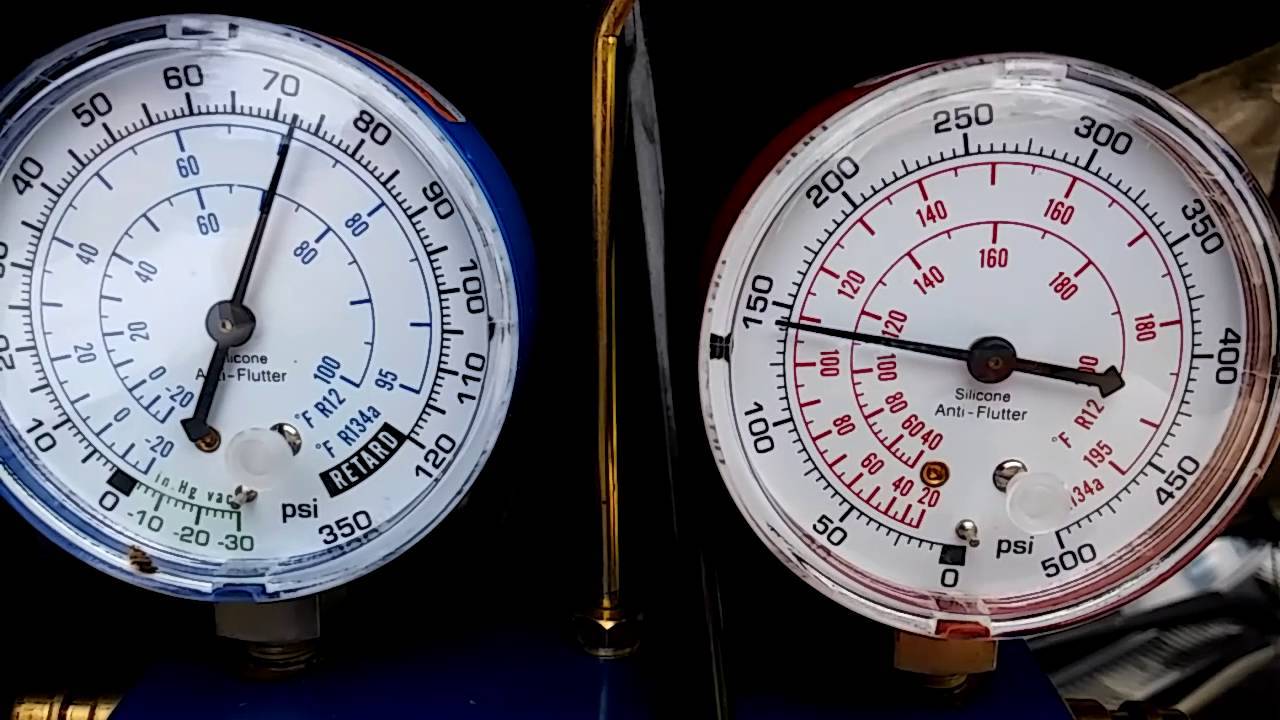

Title loans allow you to leverage your paid-off car as collateral for a short-term loan. While title loans offer some benefits, they also come with considerable risks, which you’ll want to fully understand before moving forward. Let’s weigh the pros and cons to determine if a title loan is your best option when funds run short.

The Pros Of Title Loans

Title loans are an easy lifeline when traditional credit channels fail you. These alternative lenders provide swift access to necessary funds using your car, truck, or motorcycle as collateral. Approaching companies gives you the following benefits:

- Swift Access To Emergency Funds

When financial emergencies strike, you need quick access to cash to preserve your basic necessities. Title loans can be a godsend, providing funds with nearly guaranteed approval.

If your car is in great condition, in as little as 24 hours, you can leverage your car to secure a portion of its resale value in cash—no restrictive credit check required. With such money in hand, critical needs, such as medical bills and housing payments, can be addressed. For those with few remaining options, title loans offer a timely solution when each passing day without funds magnifies stress.

- Easier To Repay

While quick access to cash is their main appeal, most title loans offer lower amounts than bank and credit union loans. Loan amounts are calculated as a percentage of your car’s resale value, usually between 25% and 50%, though this can vary by state.

That means, for a car worth USD$5,000, you’d likely qualify for a loan between USD$1,250 and USD$2,500. If you have a short-term need for a few hundred to a couple thousand dollars, a title loan may suit your purposes. Lower loan amounts also mean you’re more capable of repaying your debt. Finding cheap title loans or ones with the lowest interest rates is key.

- Widely Accessible

In addition to offering fast approval times, title loan stores are abundantly available in most areas, often clustered along busy roads and intersections. The convenience of getting cash on the spot makes these loans appealing when emergency expenses arise. You can drive up, sign some paperwork, walk out with cash, and be on your way often in a few hours or less.

- Streamlined Qualification Process

Bank loans require immaculate credit, tax documents, pay stubs, and a lengthy application detailing your financial background. In contrast, title loan qualification focuses narrowly on one factor: you own your vehicle outright without existing liens.

As long as your name is on the title, showing sole ownership, lenders can approve your loan in an hour or more based almost entirely on your car’s appraised value. They run your driver’s license, contact information, and vehicle identification number (VIN) to verify identity and ownership.

With this simple qualification process, those who were rejected by other lenders have a higher chance of access to fast cash, even with a less-than-stellar credit score.

- No Restrictions On Spending

The good news about title loans is that there are typically no restrictions on how you can spend the money. Once the cash hits your bank account, you can use the funds however necessary.

With cash in hand, you can catch up on bills, stay in your home, and feed your family. The ease and speed of qualifying make title loans an appealing option over traditional bank loans or other forms of credit when you need money immediately.

The Cons Of Title Loans

Behind the allure of obtaining credit with less effort lie exorbitant interest rates, exponential repayment cycles, and the prospect of losing your vehicle. Before turning to title loans in turbulent times, understand the risks if you don’t know how to deal with debt.

- High Interest Rates

Up to this point, title loans sound like an effective financial tool in turbulent times. But this is where extreme caution must come into play. The interest rates on title loans are quite high, averaging around 25% per month across states. And that interest starts accruing the minute you drive off the lot with cash in hand.

Miss some monthly payments along the way, and the total amount due can double quickly. As mentioned, it’s imperative to have a payoff plan in place before taking out a title loan, or you risk getting caught in a debt trap as interest eats up a huge portion of your paycheck.

- Limited Loan Amounts

While title loans offer higher chances of approval than traditional lenders, the actual loan amounts available are usually quite limited. Rather than evaluating your financial position comprehensively, title loan companies base the money they will lend solely on your car’s estimated resale value.

Title loan funds may assist in the short term but fail to address long-term issues. So if you’re looking to pay off debt exceeding USD$10,000, this loan cap may not be of much help.

- The Risk Of Losing Your Car

No one applies for a title loan expecting to lose their vehicle down the road. But this is a very real possibility you must be prepared for. A few title loan borrowers ultimately default and have their cars repossessed by lenders.

If you miss just one or two loan payments, the lender can take possession of your car, sell it to recoup their investment, and retain any excess earnings above your loan balance. Not only will you still owe any deficiency left after the car sells, but you’re also now without reliable transportation to get back and forth to work.

In Conclusion

When an urgent need for cash arises, a title loan can provide funds in as little as one day with minimal qualification requirements. However, its convenience may come at an extremely high price in the long run.

Short-term gain can easily lead to long-term financial pain if repayment plans fall through. Weigh the benefits against drawbacks carefully, create a realistic payoff strategy, and proceed cautiously if you decide a title loan is your sole resort to tackle pressing money issues. With adequate planning and discipline, you can reap the immediate rewards while avoiding the pitfalls of this potentially risky borrowing option.