Difference Between Domestic and Imported Car Insurance

Any responsible person who owns a vehicle knows that they need to have decent insurance, but not everyone is aware that there are different types of car insurance depending on where your vehicle is from. Having a good baseline of knowledge about different kinds of car insurance depending on your vehicle and other personal needs can make a big difference in your overall experience of owning a car.

One of the most important things for responsible vehicle owners is having good insurance that keeps them covered in the event of an accident. It might surprise many people to find out that different models of cars, specifically domestic or imported cars, can have different kinds of insurance coverage options available to them.

This article will go over how insurance coverage can differ between domestic and imported cars, what sorts of things can dramatically affect the cost of getting car insurance on a vehicle, what other sorts of legal requirements might differ between domestic and imported cars and end with a quick look at the way that maintenance can become a factor in choosing an insurance provider.

What exactly are the differences?

Cutting right to the chase, there are simply different insurance coverage options available depending on if you have a domestic or imported car. Typically the coverage options for domestic cars are more comprehensive and will suit people in a wider range of circumstances, domestic car insurance policies are the typical stock in trade of many different automotive insurance companies and many of them are fairly standard boilerplate.

In contrast to this, insurance coverage for imported cars can become more complex and some providers might balk at offering coverage at all. This makes it more important than ever to go through your due diligence and compare costs between different providers and try to get a good deal when you are looking at insurance providers if you own an imported car.

Something that is dear to many car owners’ hearts is coverage that can leave leeway for modifications and customizations to vehicles. Most domestic car insurance policies can be pretty flexible when it comes to coverage of modifications and customization of vehicles. Once again, policies that offer coverage for imported vehicles are less likely to be so flexible. The more exotic and rare the modifications, the more specialized the insurance coverage is likely to be to support those modifications.

What drives up premiums and costs on insurance coverage for imported cars?

It is relatively common for insurance for an imported vehicle to be more expensive than for a similar domestic vehicle. We have already mentioned that coverage itself might be harder to acquire and less flexible for these vehicles, and this is tied into the same reasons that it is likely to be more expensive as well.

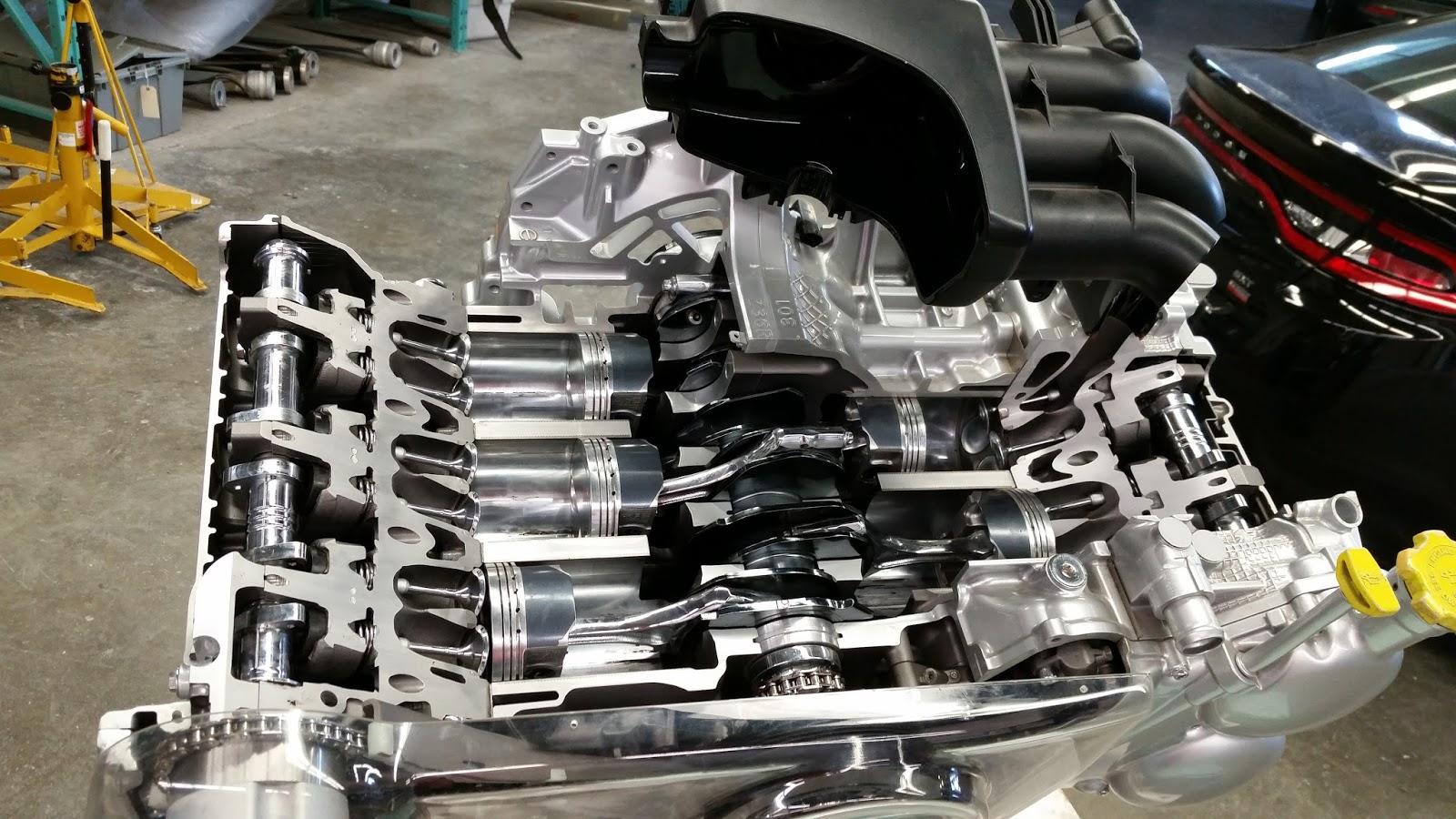

In a nutshell, much of this is due to the rarity and cost of replacement parts in the event of an accident and the expertise that is needed to conduct any repairs. On top of this, imported cars often have import taxes levied on them, which can add to their premiums.

To further exacerbate the cost, the age and rarity of the vehicle should also be considered. This same pattern can be found in domestic cars, so it should come as no surprise that classic and vintage imported cars often require specialized insurance coverage.

These insurance policies are likely to come with much less flexibility and potentially even with special requirements in regards to storage or mileage for vehicles rare or old enough. For newer luxury imported vehicles, extra costs might even be levied as they are considered at increased risk of theft.

What about the law?

So for the most part, domestic cars don’t need a whole let extra when it comes to getting them insured. Most domestic vehicles should already meet local safety and emissions standards and getting them ensured shouldn’t involve navigating too many legal hurdles.

Imported cars are not necessarily as simple a task to insure. Depending on where the car was made and where you are, some cars might require some inspections or modifications to ensure and, if necessary, bring them into line with those local road worthiness requirements. Driving a vehicle that does not meet local legal requirements for roadworthiness is a great way to acquire some fines and other penalties and is to be avoided.

Another interesting wrinkle when it comes to keeping your vehicle insured is international travel. It’s entirely possible that you might need specific coverage and documentation if you are planning on taking your vehicle across borders. While domestic car insurance policies might provide easy additive programs to acquire coverage for short cross-border trips, insurance for more exotic imported cars is unlikely to be so simple.

Maintenance and repairs

We already mentioned earlier that the maintenance and repairs for exotic and imported vehicles can be a sticking point for insurance companies. While domestic cars are likely to be able to be serviced from any one of a dozen or more nearby locations and have parts that are easy to procure, exotic imported vehicles that become damaged are very unlikely to have such a straightforward repair process ahead of them.

Because of this, you should expect premiums on exotic imported vehicles to be high and insurance costs overall to be higher. This makes it important that you choose a insurance provider that specializes in insuring imported vehicles if you own one, as such an insurance company is likely to be able to help expedite the process and make it easier on you.

To conclude, choosing the right sort of insurance for your vehicle and your needs is very important and should be a factor in deciding what sort of vehicle you want from the outset. It’s important to be aware that while the thrill or prestige of owning a more exotic imported vehicle could be appealing, that ownership of such a vehicle is approached in a responsible manner and the realities of insuring an imported car are simply more complex than other vehicles.