5 Things to Know Before Buying Insurance for a NASCAR Car

Insuring a NASCAR vehicle isn’t as straightforward as insuring an everyday car. Multiple factors come into play, such as the model of the car, the racing itinerary, and the driver’s track record. The insurance premium can significantly fluctuate based on these elements, although obtaining a rough estimate of the likely costs is feasible. However, before we delve into that, let’s explore what you should know before getting your NASCAR racing vehicle insurance.

Mandatory Purchase

The law applies equally to all, and just like anyone else, NASCAR car owners are also required to purchase car insurance. At the very least, a third-party car insurance plan must be acquired in accordance with the law for your vehicle’s insurance. However, it’s recommended to choose a Comprehensive Plan for extensive coverage.

Car insurance policies have a specific duration, after which they expire. As a car owner, it’s your responsibility to ensure the renewal of your auto insurance policy before its expiration date. This is vital as an expired policy has no value and won’t provide any insurance coverage.

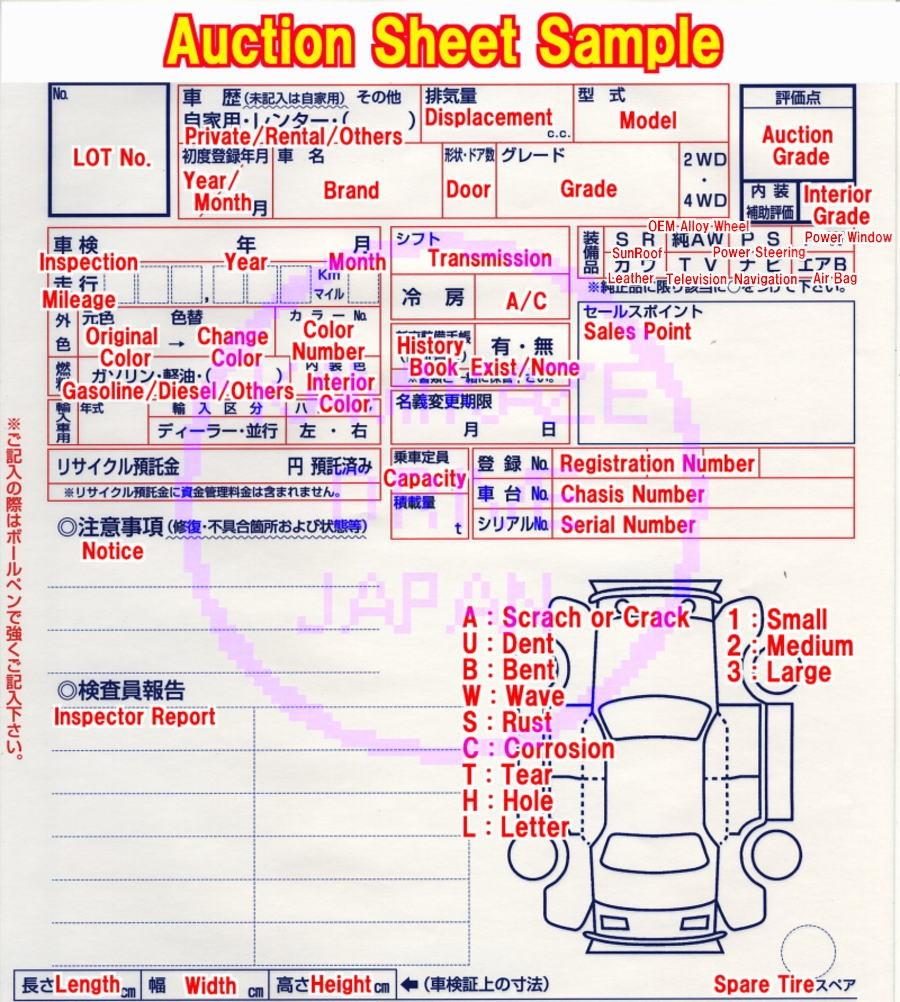

The Kind of Car Determines the Insurance Premium Rates

The style and model of a NASCAR car significantly influence the determination of insurance premium rates. Many insurance companies utilize actuarial statistic tables, which provide past loss experiences related to various styles and types of vehicles.

Insurers can use these tables to identify and estimate the premiums customers may charge in the upcoming period. Cars with lower mileage and more than three or four years old sometimes receive lower insurance coverage. You might secure inexpensive car insurance in such instances since your car isn’t new. Additionally, you can always purchase a new car and insure it immediately. Some car dealers also partner with car insurance firms to provide a convenient one-stop solution.

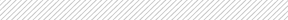

Potential Examination

Before purchasing insurance for a NASCAR car, be aware of the possibility of an inspection. Given the unique characteristics of NASCAR cars, certain insurance providers may require a thorough examination of the vehicle before they agree to provide coverage.

Understandably, they won’t commit to insuring a deemed unsafe or illegal vehicle, and some might not offer you a policy. Confirm if your chosen insurance company will insure your NASCAR car before you finalize the purchase. If they won’t, you’ll probably need to look for a different provider.

Check it Out on the Web

Discounted car insurance options are readily available online, and consumers can utilize statistical data from various providers to understand the premium rates tied to different vehicles. Many car insurance companies offer comprehensive information online in the present digital era. In addition, independent websites facilitate comparison of different policies, enabling you to make an informed decision based on your specific needs.

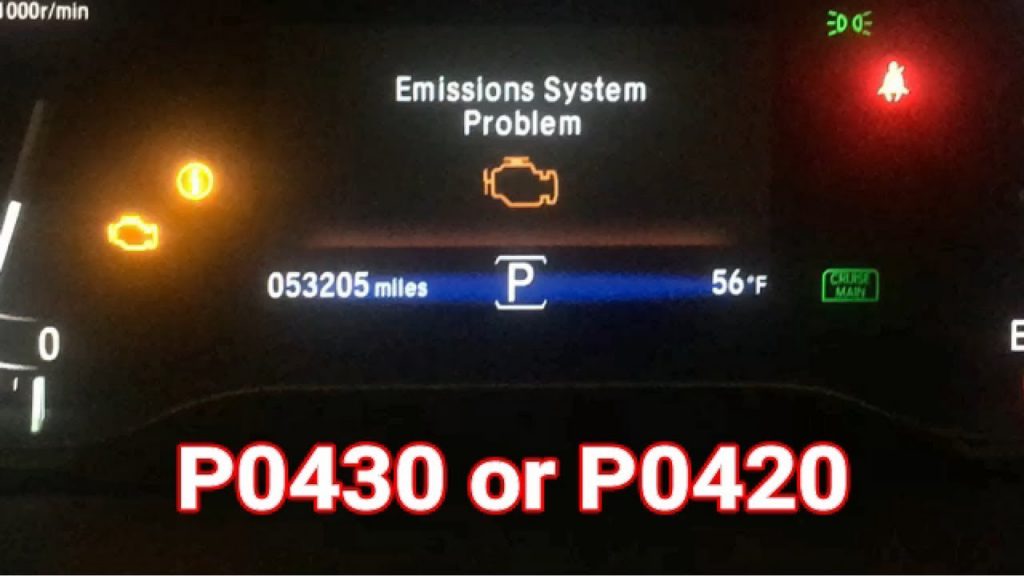

For example, NASCAR cars often partake in high-risk driving activities, making them more susceptible to accidents and damage. Insurance companies typically levy higher premiums for these cars than regular vehicles.

Your History and Record of Driving

Your driving record and history can influence the cost of your car insurance premium. This is because drivers with multiple traffic accidents or violations are considered higher risk. A proven method to reduce this risk, and potentially lower your premium, is by strictly adhering to all traffic regulations and speed limits. This decreases your chances of being involved in an accident or getting a speeding ticket, and also demonstrates safe driving behaviors.

Endnote

Covering a NASCAR car can be costly, with the insurance rate typically increasing with the vehicle’s horsepower and price. It’s beneficial to compare prices from different insurers and discuss potential savings with your current provider. Despite owning a high-performance NASCAR car, you may still qualify for discounts like those offered for policy combination or exhibiting safe driving habits.