From finding a suitable car from a reputable car exporter to shipping and clearing your vehicle at a Kenyan port, dive deeper into the basic procedures and some notable aspects of how to import a car from Japan to Kenya.

Contents

Can I Import and Register a Car from Japan to Kenya?

You can import and register a car from Japan to Kenya legally and quickly in this era of technological development with a myriad of advanced support means, from electronic systems to human agility.

However, importing a car into another country requires a lot of effort and attention, especially regarding the laws and all kinds of costs that need to be covered.

One thing to note before choosing any car model circulating on the streets of Kenya is the car’s age.

Cars entering Kenya are required to comply with a law called Kenya Bureau of Standards requirements of Legal Notice No. 78 of 15th July 2005 (Verification of Conformity to Kenya Standards Imports Order, 2005) and Kenya StandardCode of Practice for inspection of road vehicles (KS 1515: 2000). In which:

- Vehicles under 8 years old from the first year of registration. For example, in 2025, vehicles allowed to be imported into Kenya must be from 2018 onwards.

- Vehicles will be subject to a roadworthiness inspection by an inspection agent designated by the Kenya Bureau of Standards (KEBS) in the exporting country.

- Imported vehicles have right-hand drive.

These are just some common vehicle laws that you should pay special attention to when choosing your favorite vehicle model to import into Kenya.

Furthermore, there are quite a few notices about tax and duty that can make the process complicated and a bit confusing. But don’t worry, you are not alone on this journey because we will clear up the information right away.

Pros and Cons of Importing Cars from Japan

Before delving into the process of importing cars from Japan to Kenya, you need to consider carefully the strengths and weaknesses of this car line.

They may satisfy you in aspects of performance or design but can still lose points because of annoyed taxes or paperwork.

Benefits of a Car From Japan

As the old saying goes, cars from Japan are known for their durability and powerful performance. And that could be the first reason you choose one as your companion on every journey.

Moreover, compared to cars available in the local Kenyan market, Japanese dealers are outstanding thanks to their diverse model offerings in design, engine, and performance, suitable for each individual’s needs.

Another strength of Japanese cars is their bargain prices. Whether it is a new model or a quality second-hand one, you will always be able to own it at a price range that is not available anywhere else in Kenya (maybe only 30% – 40% of the original price).

Drawbacks To Purchase a Car From Japan

Overall, many reasons can prevent buying a car from Japan to Kenya from becoming a comprehensive shopping experience.

Not only does it have to go through a complex process with many legal steps and procedures, but the car may have to go through more than one ordeal for you to use and circulate in Kenya.

Taxation is a big part of the complexity of the process, for example, import tax or customs duty imposed on foreign vehicles, with some types costing up to 30-35% of the import price.

Moreover, not all types of cars can easily pass the border gate. If they violate the age of imported vehicles and do not meet the technical supervision regulations before and after customs, those cars will never be able to board the ship.

Ironically, even if they can get on the ship to leave the port for Kenya, the fate of Japanese cars can still be turned around due to uncertainties arising from the port or ship’s damages.

So, it can be said that buying and shipping cars from Japan will bring many benefits as well as potential risks.

However, if successful, the values you receive will outstrength everything.

How to Import a Car from Japan to Kenya: The Steps

Generally, compared to some European countries’ procedures like import to UK or Ireland, importing a car from Japan to Kenya is not as complicated and confusing as many think. You can master the process with hundreds of support sources and understand the following basic process.

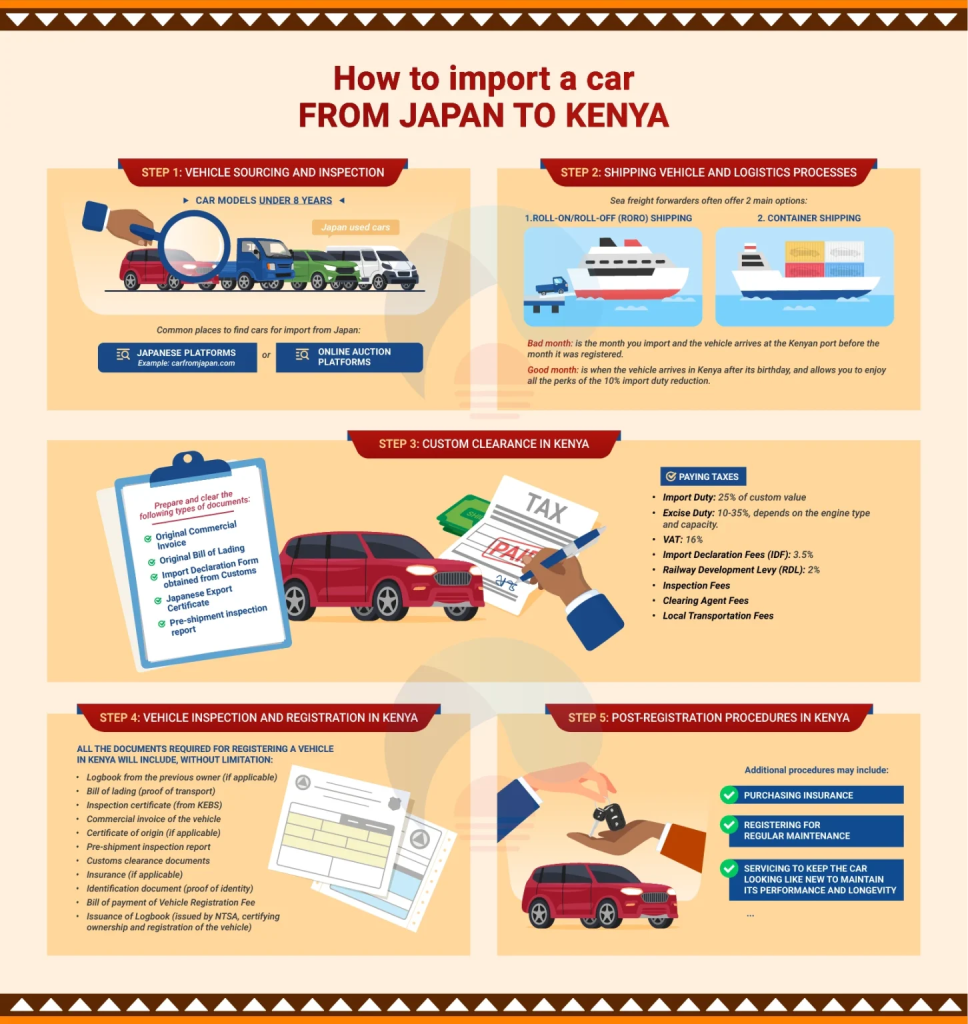

Step 1. Vehicle sourcing and inspection

The first step to bringing your dream car home is to choose a car and do an initial technical inspection.

Comprehensive research for the right car model will save you a lot of trouble later. Along with the note about the law on importing cars under 8 years old, you also need to pay attention to the general condition of the car, including mileage, engine, paint, exhaust, or basic cabin/safety features.

If you connect with a third party, before entrusting a certain unit, make sure they are a professional and reputable party.

Now, not only do you research your dream car, but you also have to pay attention to a series of notices, warnings (if any), or all kinds of reviews on various platforms where users can evaluate this unit or company.

Once you have selected the vehicle, book a pre-shipment inspection conducted by experienced Japanese inspectors. They will examine and evaluate all the different aspects of the target vehicle.

The evaluations will include the mechanical and electrical systems, the body (paint, windows, roof, etc.), and the interior. Concerns about the vehicle include potential damage to the body, mechanical problems, or safety features.

This inspection report can be helpful for information about the vehicle’s condition, ensuring export and customs clearance standards, or more importantly, when you want to negotiate the price for any unforeseen defects.

Step 2. Shipping vehicle and Logistics processes

Once you have the car on paper (in the name) and have undergone a thorough pre-import inspection, you must proceed to a safe and smooth shipping process from Japan to Kenya.

Here, you choose the suitable transportation method for the purpose and condition of the car, which will also significantly affect the cost and time of receiving. Two popular methods include:

Roll-on/Roll-off (Ro-ro)

- Cost-saving, becoming a popular choice for many units and car importers.

- The car is loaded directly onto and off the ship.

- There is less handling and less risk of damage when loading and unloading the car at/from the port.

- Ro-ro ships are designed to load vehicles with safe parking inside.

Transport by container

- Cars will be better protected during transportation.

- Vehicles are loaded into containers safely, avoiding damage from external factors.

- Suitable for specialized vehicles, vehicles that require high/absolute protection

- The cost of loading-unloading and transporting is higher than using Ro-ro ships.

Depending on the requirements and available budget, with the specific condition of that car from Japan and the available shipping options, you will have time to carefully consider one more criterion to ensure a successful import trip.

Next, schedule and arrange for the vehicle to enter the port of Mombasa in Kenya. Contact the shipping company, complete the vehicle shipping schedule, and receive important documents such as the bill of lading.

Another thing to note is that before intending to bring any type of vehicles into Kenya, especially vehicles, consider the Good month and Bad month.

Bad month and Good month in importation refers to the month you pick up your vehicle in Kenya so that it is of age and eligible and will not be charged any additional fees. The later the car arrives at the port after the accepted age, the lower the duty you will pay.

First of all, a bad month is the month you import and the vehicle arrives at the Kenyan port before the month it was registered.

For example, when buying a Toyota Hilux registered in March 2018, if the vehicle arrives at Mombasa port in Kenya in February 2025, just 1 month before the vehicle is of age, you will have to pay an additional 10% duty.

Conversely, a good month is when the vehicle arrives in Kenya after its birthday, and allows you to enjoy all the perks of the 10% import duty reduction.

Make sure your vehicle arrives at Mombasa port in the right month, avoiding vehicles that are close to the 8-year age limit, so that you can save some money on the vehicle age tax.

Not only that, the peak time of the year or the festival season will also be when shipping prices skyrocket, which is not too favorable for any car import.

Step 3. Custom clearance in Kenya

At this step in our process of how to import a car from Japan to Kenya, you can choose to contact or find a licensed third party to guide and handle various documents to help your car clearance process go smoothly and efficiently.

If you have experience and knowledge of the procedures that need to be covered or want to do customs clearance yourself, you should prepare and clear the following types of documents:

- Original Commercial Invoice

- Original Bill of Lading

- Import Declaration Form obtained from Customs

- Japanese Export Certificate

- Pre-shipment inspection report

And after preparing all the necessary papers, we come to the part of determining and paying taxes. The two most important taxes are excise duty and value-added tax (VAT).

The amount of tax will depend on the imported car’s value, age, and engine capacity. You can get the amount of tax to pay by a customs broker or from the information you find yourself to estimate the import costs before making any purchase.

Below are some notes on the taxes you need to cover and some points to note from them:

- Import Duty: 25% of custom value, not applicable for ambulances and hearses (cars of special purposes)

- Excise Duty: depends on the engine, cylinder capacity, and propulsion system. Refer to the following table.

| Vehicle Type | Engine | Cylinder Capacity | Excise Duty Rate |

| Gasoline Vehicles (Spark-Ignition) | Internal Combustion Engine | 1,000 cc – 1,500 cc | 20% |

| 1,500 cc – 3,000 cc | 25% | ||

| Above 3,000 cc | 35% | ||

| Diesel Vehicles (Compression-Ignition) | Internal Combustion Engine | Up to 1,500 cc | 25% |

| 1,500 cc – 2,500 cc | 25% | ||

| Above 2,500 cc | 35% | ||

| Hybrid Vehicles | Gasoline Engine + Electric Motor (Non-Plug-in Hybrid) | Any capacity | 25% |

| Diesel Engine + Electric Motor (Non-Plug-in Hybrid) | Any capacity | 25% | |

| Gasoline Engine + Electric Motor (Plug-in Hybrid) | Any capacity | 25% | |

| Diesel Engine + Electric Motor (Plug-in Hybrid) | Any capacity | 25% | |

| Electric Vehicles | Electric Motor Only | Any Capacity | 10% |

- Value Added Tax (VAT): 16%

- Import Declaration Fees (IDF): 3.5% charged by the Kenya Revenue Authority (KRA) for processing the import declaration.

- Railway Development Levy (RDL): 2% – fee to support the development of Kenya’s railway infrastructure

- Inspection Fees: fee for inspection to ensure safety and environmental standards from the Kenya Bureau of Standards

- Clearing Agent Fees: fee paid to a customs clearance agent if you hire them at customs

- Local Transportation Fees: transportation fees (if any) from the port of Mombasa to you.

Step 4. Vehicle inspection and registration in Kenya

Before your vehicle can be on the road in Kenya, it must first undergo a comprehensive roadworthy inspection by KEBS or a reputable authorized agency.

The second inspection by the Bureau will continue to evaluate the vehicle’s mechanical features and safety systems (such as brakes, lights, tires, exhaust system, emissions levels, etc.), ensuring that the vehicle is safe to drive and meets environmental standards.

Once your car passes the inspection in Kenya, we move on to the registration process with the competent authorities.

In Kenya, go to the Kenya Revenue Authority (KRA) and the National Transport and Safety Authority (NTSA) to apply for a vehicle registration number (Logbook – Vehicle Registration Certificate) and follow up with further information to complete the process. Beware of some additional requirements, documents, or fees.

Please note that the Kenya Revenue Authority will not accept Export Certificates issued by foreign agencies (e.g. Dubai Police) as a substitute for Logbooks or foreign documents.

If the Logbook is in a foreign language, you must present an English translation issued by the Embassy, High Commission, or Consulate to customs to prove its authenticity.

In addition, at the competent authorities, pay attention to applying for a driving license or other relevant permits to operate your exported vehicle freely and legally on Kenyan roads.

In summary, all the documents required for registering a vehicle in Kenya will include, without limitation:

- Logbook from the previous owner (if applicable)

- Bill of lading (proof of transport)

- Inspection certificate (from KEBS)

- Commercial invoice of the vehicle

- Certificate of origin (if applicable)

- Pre-shipment inspection report

- Customs clearance documents

- Insurance (if applicable)

- Identification document (proof of identity)

- Bill of payment of Vehicle Registration Fee

- Issuance of Logbook (issued by NTSA, certifying ownership and registration of the vehicle)

Step 5. Post-registration procedures in Kenya

After completing the basic steps in the process of how to import a car from Japan to Kenya above, there are just a few important post-processing steps that need to be completed before the car is completely yours legally.

Additional procedures may include purchasing insurance, registering for regular maintenance, and servicing to keep the car looking like new to maintain its performance and longevity.

Wishing you a successful car buying and importing period!

How Much Does It Cost to Import a Car from Japan to Kenya?

We have compiled the main costs of importing cars from Japan to Kenya in the table below. Hopefully, you can use it as a reference when predicting and preparing for the expense of the whole process.

Expect in advance that the total cost will be about 50% – 90%, or even 100% of the car’s CIF value (the cost, insurance, and freight price for imported cars). This price will also depend on the age, condition, and engine capacity of your car.

| Cost Category | Average Cost (NOK) | Details |

| Purchase Price | Varies500,000 – 2,500,000 KES | Age, condition or rarity |

| Shipping Costs | 80,000 – 150,000 KES | Vehicle size, mode of transport |

| Import Duty | 25% of CIF Value | Cost, Insurance and Freight (CIF) basis |

| Excise Duty | 10% – 35% of CIF + Import Duty | Engine capacity and vehicle age |

| VAT (Value Added Tax) | 16% of CIF + Import Duty + Excise Duty | |

| Railway Development Levy (RDL) | 2% of CIF Value | Infrastructure development fees in Kenya |

| IDF Fee (Import Declaration Fee) | 3.5% of CIF Value (min 5,000 KES) | Cost of import declaration process |

| Port Handling Fees | 10,000 – 20,000 KES | |

| Inspection Fee | 18,000 – 25,000 KES | |

| Registration Fee | 10,000 – 15,000 KES | Cost of vehicle registration in Kenya, including license plates. |

| Insurance | 30,000 – 150,000 KES/per year | Comprehensive insurance or third party insurance |

| Other Costs | 5,000 – 15,000 KES | Documents, more customs clearance fees and other costs. |

How Long Does It Take To Import a Car from Japan to Kenya?

In general, for a car to arrive from Japan to Kenya safely without any missteps throughout the process, the average time will be between 2 and 3 months.

However, keep in mind that there will be some cases of delayed ship encounters, customs procedures, or complexity in paperwork.

Below is a reference timetable for the steps within the process.

| Stage | Duration | Detail |

| Car Purchase/Auction | 1 – 2 weeks | Car purchase |

| Export Preparation in Japan | 1 – 2 weeks | Export documents preparation |

| Shipping (Sea Freight) | 4 – 6 weeks | Shipping time from Japan to the port of Mombasa |

| Port Clearance and Customs Processing | 1 – 2 weeks | Customs duty payment, inspection, and clearance by the Kenya Revenue Authority (KRA). |

| Vehicle Inspection and Approval | 1 – 2 weeks | Further inspection for Kenya standard |

| Registration and Plate Issuance | 1 week | Register with KRA, issue license plates in Kenya |

For more information on how to import a car from Japan to Kenya, reach out to Car From Japan to inquire about anything you wish for today!